What is the Stepped-Up Basis, and Why Does the Biden Administration Want to Eliminate It?

The step-up in basis is a provision in tax law that relates to how assets — such as stocks, bonds, or real estate — are valued and taxed after their owner passes away.

One Year after Joe Biden's Inauguration, BU Experts Give Him a Mixed Review, BU Today

Did Biden Vow To Eliminate the 'Stepped-Up' Basis for Capital Gains Tax?

Why The Stepped-Up Basis Must Be Preserved For Our Children

Inside the $40-billion-a-year tax 'loophole' Biden's plan would eliminate

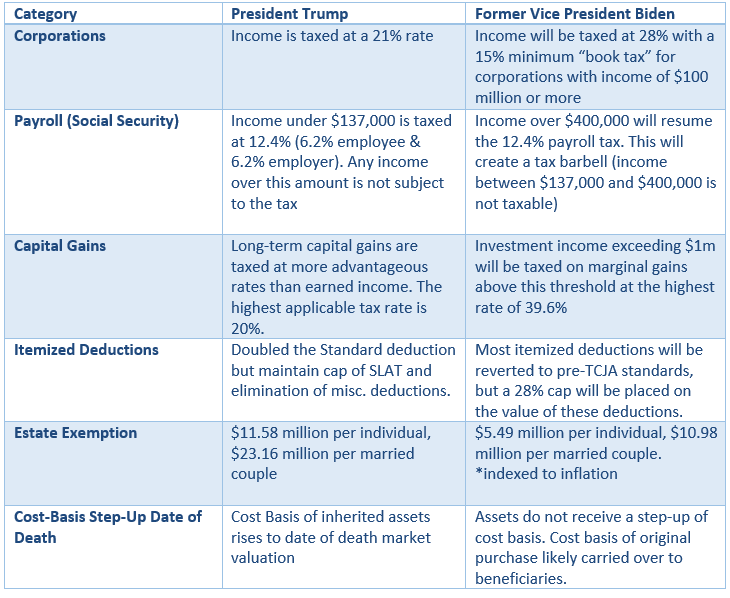

President Biden's Changes to the Stepped-Up Basis Provision

2020 Planning Opportunities: Potential Tax Changes and Roth Conversions - Weatherly Asset Management

Step-Up in Basis Tax Benefit for Estate Plan

What is the Stepped-Up Basis, and Why Does the Biden Administration Want to Eliminate It?

Biden Hopes to Eliminate Stepped-Up Basis for Millionaires

Billionaires Beat the Working Rich in Biden's Spending Bill - The New York Times

Biden's Estate Tax Proposal Includes Canadians with U.S. Assets

Nineteen Conflict Prevention Tips for the Biden Administration

Is Repealing The Tax-Free Basis Step Up Really Dead?

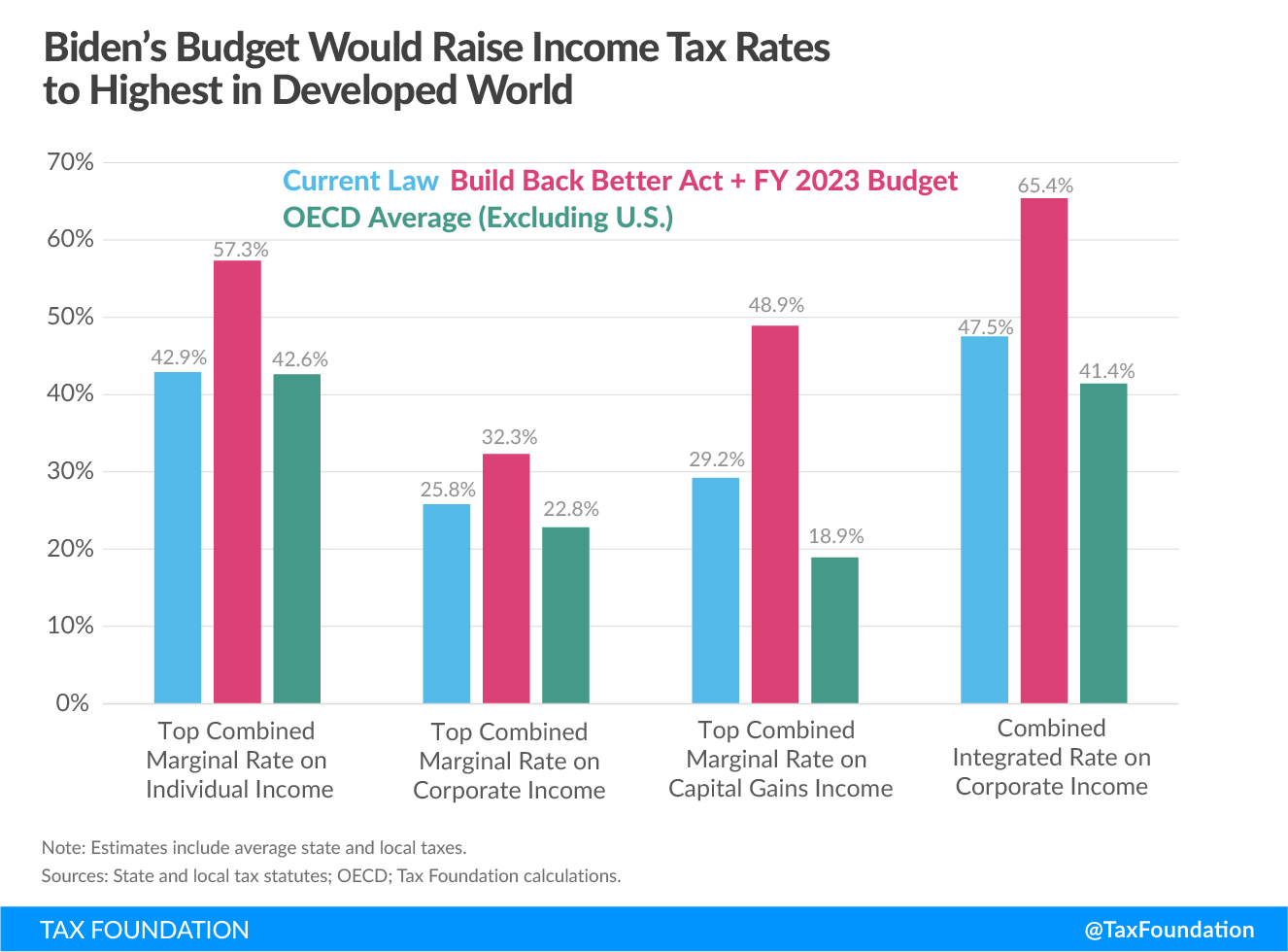

Biden Budget & Biden Tax Increases: Details & Analysis

Tracking regulatory changes in the Biden era